Philanthropy

Studio Society

Studio Society members lead the community through their generosity and advocacy for public media.

President’s Society

Donors who act on a deeper commitment to public media, understanding that extraordinary accomplishments require higher levels of contributions.

Visionary Society

Share the treasure of public media with future generations by remembering TPT in your will or estate plans.

Foundations

Foundations and corporations provide TPT critical support to sustain its impact and further its mission in Minnesota.

Studio Society members lead the community through their generosity and advocacy for public media.

Studio Society contributors ensure that Twin Cities PBS (TPT) continues to use the power of media to engage, inform and inspire. As our philanthropic partners, their support helps build stronger communities both within and beyond our region.

TPT’s Studio Society recognizes annual contributions of $1,000 – $9,999 to help strengthen the impact of public media now and in the future. Learn more about how your philanthropy makes a material difference here.

For more information about the Studio Society, please contact Caitlin Zintl, Sr. Manager of Individual Giving & Development at 651-229-1403 or [email protected].

Twin Cities Public Television, Inc. is a 501(c)(3) tax-exempt organization under section 501(c)(3) of the Internal Revenue Code.

JOIN TODAYGiving Levels & BENEFITS

Viewers

$1,000 – $2,499

DirectorS

$2,500 – $4,999

Executive ProducerS

$5,000 – $9,999

Along with TPT member benefits like Passport, you will receive a number of additional opportunities afforded only to Studio Society members including:

- Invitations to private Studio Society events including: TPT’s Annual Recognition Luncheon with President & CEO, receptions with PBS talent, premiere screenings, behind-the-scenes evenings and station tours.

- Discounted tickets to station-wide events.

- Access to the DVD Lending Library.

- Advance notice of upcoming projects and programs.

- Recognition in TPT ’s Annual Donor Listing.

|

HOW TO GIVE

|

There are a variety of ways to make a charitable gift, which may provide tax advantages for you. Please consult your adviser for your best giving option(s). Below are a few recommendations for consideration.

STOCK

Donating appreciated securities is a great way for you to make a gift to TPT. You can deduct the full present fair market value and you owe no tax on the appreciation in value. To make a stock gift to TPT, you will need to give the following information to your broker:

- Firm: UBS Financial Services Inc.

- Primary Contact: Michael Block, (612) 303-5842, [email protected]

- Twin Cities Public Television, Account number: 7A30673

- DTC number: 0221

Please also contact Abbey Sepich, Development Assistant, at (651) 229-1548 or [email protected] with your name, type of stock and the number of shares so we can provide documentation for your tax deduction.

IRA DISTRIBUTIONS

At age 70 ½, IRA owners are required by law to take mandatory minimum distributions. An increasingly popular way to make gifts tax-free, transfers to TPT must be made directly from the IRA or by writing a check from the IRA up to a $100,000 limit. Now that the IRA Charitable Rollover legislation is passed permanently, this enables donors to plan each year in advance.

Full Legal Name of TPT: Twin Cities Public Television, Inc.

Federal Tax I.D. Number: 41-0769851

MORE GIVING OPTIONS

CASH

STOCK

RETIREMENT PLAN ASSETS

IRA DISTRIBUTIONS

LIFE INSURANCE

BEQUESTS

DONOR ADVISED FUNDS

FAMILY FOUNDATIONS

CHARITABLE GIFT ANNUITY

CHARITABLE REMAINDER ANNUITY TRUSTS

CHARITABLE LEAD TRUSTS

CASH

A gift of cash is an easy way for you to make a gift to TPT. You can make an immediate impact on our mission and benefit from a charitable income tax deduction. Checks should be made out to Twin Cities PBS and mailed to:

Development Office

Twin Cities PBS

172 E. 4th Street

St. Paul, MN 55101

STOCK

Donating appreciated securities is a great way for you to make a gift to TPT. You can deduct the full present fair market value and you owe no tax on the appreciation in value. Stockbrokers require delivery instructions in writing. To make a stock gift to TPT, you will need to give the following information to your broker:

- Firm: UBS Financial Services Inc.

- Primary Contact: Michael Block, (612) 303-5842, [email protected]

- Twin Cities Public Television, Account number: 7A30673

- DTC number: 0221

Please also contact Abbey Sepich, Development Assistant, at (651) 229-1548 or [email protected] with your name, type of stock and the number of shares so we can provide documentation for your tax deduction.

RETIREMENT PLAN ASSETS

Donating part or all of your unused retirement assets such as a gift from your IRA (IRA charitable Rollover), 401(k), 403(b), pension or other tax-deferred plan is an excellent way to make a gift. Benefits of gifts of retirement assets:

- Avoid potential estate tax on retirement assets

- Your heirs would avoid income tax on any retirement assets funded on pre-tax basis

- Receive potential estate tax savings from an estate tax deduction

To leave your retirement assets to TPT, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate TPT as beneficiary, we will benefit from the full value of your gift because your IRA assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

IRA DISTRIBUTIONS

At age 70 ½, IRA owners are required by law to take mandatory minimum distributions. An increasingly popular way to make gifts tax-free, transfers to TPT must be made directly from the IRA or by writing a check from the IRA up to a $100,000 limit. Now that the IRA Charitable Rollover legislation is passed permanently, this enables donors to plan each year in advance.

LIFE INSURANCE

A gift of your life insurance is an excellent way to make a gift to TPT. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy. Contact your insurance provider, request a beneficiary designation form and include TPT as the beneficiary of your policy.

BEQUESTS

Including Twin Cities PBS in your will is an easy way to make a generous gift to TPT.

In your will you have choices about how you name TPT as a beneficiary.

- You may wish to leave a fixed dollar amount to TPT. You will need to specify exactly how much you would like the station to receive.

- Another popular option is to give Twin Cities PBS a percentage of your estate. This makes good sense if you don’t have a clear idea of how much your estate will be worth at your death.

Tell Your Attorney

Below is suggested language that you might use in your will to designate Twin Cities PBS as a beneficiary.

I give devise to Twin Cities Public Television, Inc., a not-for-profit corporation of the State of Minnesota, ____percent of my estate (or the residue or the sum of $_____; or the properties, securities, etc. described herein) to be used for its unrestricted purposes, or for its endowment.

If You Already Have a Will

It is very easy to add a codicil to your will, which designates TPT as one of your beneficiaries.

Full Legal Name of TPT: Twin Cities Public Television, Inc.

Federal Tax I.D. Number: 41-0769851

Please let us know if you have included TPT in your plans.

DONOR ADVISED FUNDS

Through Donor-Advised Funds, you make irrevocable contributions to a fund you establish, often in your name or to honor a family member. The most typical charitable sponsors are community foundations and funds affiliated with financial service firms. You then claim a charitable deduction for income tax purposes and recommend that money be granted to TPT. These organizations work closely with us to fulfill your charitable goals. Please allow 2-3 months for your recommendation to be fulfilled by calendar year end.

FAMILY FOUNDATIONS

Another option to match your philanthropic intent with TPT’s public media mission is to make a grant from your family foundation. A private family foundation by law must distribute a minimum of 5% of its assets yearly to charity. TPT often benefits from family foundations who give grants for general operations or to fund a specific content area or program. TPT works closely with family members and/or foundation appointed administrators to jointly fulfill the mission of donors and TPT.

CHARITABLE GIFT ANNUITY

The Charitable Gift Annuity (CGA) is one of the oldest and most popular ways to support a favorite charity. It is simple to complete and provides income for you or another individual of your choice as well as tax benefits.

In exchange for your gift of cash or marketable securities, TPT agrees to pay you (and/or a loved one) an annual sum for the remainder of your life(lives). The amount of the annuity is based on the age of the income beneficiary(ies): the older you are, the higher the rate you will receive.

A CGA is a simple contract between a donor and a charity, such as Twin Cities PBS. The contract specifies the amount of income to be paid annually (the “annuity”) to the donor; the name of the individual (or individuals) who will receive the income; and the charitable purpose of the gift after the life of the income recipient(s).

CGAs can be established with a gift of $10,000 or more and qualify you for an immediate income tax deduction. And, a portion of the yearly income is tax-free. You may also receive favorable capital gains tax treatment when making gifts of appreciated property.

CHARITABLE REMAINDER ANNUITY TRUSTS

A Charitable Remainder Annuity Trust (Annuity Trust) is a gift plan defined by federal tax law that allows you to provide income to yourself or others while making a generous gift to Twin Cities PBS. The income may continue for the lifetimes of the beneficiaries you name, a fixed term of not more than 20 years, or a combination of the two.

CHARITABLE LEAD TRUSTS

A Non-Grantor Charitable Lead Annuity Trust (Lead Annuity Trust) is a gift plan defined by federal tax law that allows you to transfer assets to family members at reduced tax cost while making a generous gift to Twin Cities PBS.

“I believe in helping children and lifelong learning. As a Studio Society member, my support makes a difference.”

LaVonne Ellingson, Studio Society member

“I believe in helping children and lifelong learning. As a Studio Society member, my support makes a difference.”

LaVonne Ellingson, Studio Society member

President’s Society members believe deeply in the power of public media to transform our society.

President’s Society donors give generously to Twin Cities PBS (TPT) and together, we impact society through the power of media. Donors believe that extraordinary accomplishments require greater contributions and often express philanthropic intent through donor advised funds, trusts, and family foundations.

With leadership gifts of $10,000 – $100,000, President’s Society contributors provide essential investments that allow TPT to develop, deliver and sustain high-quality programs, and supply resources for future innovation.

Donations are applied where it is needed most or may be directed to a TPT content or program area. Learn more about how your philanthropy inspires impact here.

For more information about the President’s Society, please contact Melinda Hoke, Vice President of Philanthropy at 651-229-1417 or [email protected].

Twin Cities Public Television, Inc. is a 501(c)(3) tax-exempt organization under section 501(c)(3) of the Internal Revenue Code.

JOIN TODAYGIVING LEVELS & BENEFITS

PRESIDENTS

$10,000 – $24,999

TRUSTEES

$25,000 – $49,999

INVESTORS

$50,000 – $99,999

INNOVATORS

$100,000+

In addition to Studio Society privileges and TPT member benefits like Passport, you will receive a number of additional opportunities afforded only to President’s Society members including:

In addition to Studio Society privileges and TPT member benefits like Passport, you will receive a number of additional opportunities afforded only to President’s Society members including:

- The ability to direct giving to a personal passion or station initiative.

- Invitations to exclusive local and national events with PBS luminaries.

- A select Almanac evening or Program screening reserved for you and your guests.

- Special on-air and in-print recognition.

- Private dinner or lunch and station update with the President and CEO.

- The deep satisfaction in knowing that President’s Society philanthropy transforms the station and makes a material difference in the communities we serve.

|

how to give

|

There are a variety of ways to make a charitable gift, which may provide tax advantages for you. Please consult your adviser for your best giving option(s). Below are a few recommendations for consideration.

IRA DISTRIBUTIONS

At age 70 ½, IRA owners are required by law to take mandatory minimum distributions. An increasingly popular way to make gifts tax-free, transfers to TPT must be made directly from the IRA or by writing a check from the IRA up to a $100,000 limit. Now that the IRA Charitable Rollover legislation is passed permanently, this enables donors to plan each year in advance.

Full Legal Name of TPT: Twin Cities Public Television, Inc.

Federal Tax I.D. Number: 41-0769851

DONOR ADVISED FUNDS

Through Donor-Advised Funds, you make irrevocable contributions to a fund you establish, often in your name or to honor a family member. The most typical charitable sponsors are community foundations and funds affiliated with financial service firms. You then claim a charitable deduction for income tax purposes and recommend that money be granted to TPT. These organizations work closely with us to fulfill your charitable goals. Please allow 2-3 months for your recommendation to be fulfilled by calendar year end.

FAMILY FOUNDATIONS

Another option to match your philanthropic intent with TPT’s public media mission is to make a grant from your family foundation. A private family foundation by law must distribute a minimum of 5% of its assets yearly to charity. TPT often benefits from family foundations who give grants for general operations or to fund a specific content area or program. TPT works closely with family members and/or foundation appointed administrators to jointly fulfill the mission of donors and TPT.

MORE GIVING OPTIONS

CASH

STOCK

RETIREMENT PLAN ASSETS

IRA DISTRIBUTIONS

LIFE INSURANCE

BEQUESTS

DONOR ADVISED FUNDS

FAMILY FOUNDATIONS

CHARITABLE GIFT ANNUITY

CHARITABLE REMAINDER ANNUITY TRUSTS

CHARITABLE LEAD TRUSTS

CASH

A gift of cash is an easy way for you to make a gift to TPT. You can make an immediate impact on our mission and benefit from a charitable income tax deduction. Checks should be made out to Twin Cities PBS and mailed to:

Development Office

Twin Cities PBS

172 E. 4th Street

St. Paul, MN 55101

STOCK

Donating appreciated securities is a great way for you to make a gift to TPT. You can deduct the full present fair market value and you owe no tax on the appreciation in value. Stockbrokers require delivery instructions in writing. To make a stock gift to TPT, you will need to give the following information to your broker:

- Firm: UBS Financial Services Inc.

- Primary Contact: Michael Block, (612) 303-5842, [email protected]

- Twin Cities Public Television, Account number: 7A30673

- DTC number: 0221

Please also contact Abbey Sepich, Development Assistant, at (651) 229-1548 or [email protected] with your name, type of stock and the number of shares so we can provide documentation for your tax deduction.

RETIREMENT PLAN ASSETS

Donating part or all of your unused retirement assets such as a gift from your IRA (IRA charitable Rollover), 401(k), 403(b), pension or other tax-deferred plan is an excellent way to make a gift. Benefits of gifts of retirement assets:

- Avoid potential estate tax on retirement assets

- Your heirs would avoid income tax on any retirement assets funded on pre-tax basis

- Receive potential estate tax savings from an estate tax deduction

To leave your retirement assets to TPT, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate TPT as beneficiary, we will benefit from the full value of your gift because your IRA assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

IRA DISTRIBUTIONS

At age 70 ½, IRA owners are required by law to take mandatory minimum distributions. An increasingly popular way to make gifts tax-free, transfers to TPT must be made directly from the IRA or by writing a check from the IRA up to a $100,000 limit. Now that the IRA Charitable Rollover legislation is passed permanently, this enables donors to plan each year in advance.

LIFE INSURANCE

A gift of your life insurance is an excellent way to make a gift to TPT. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy. Contact your insurance provider, request a beneficiary designation form and include TPT as the beneficiary of your policy.

BEQUESTS

Including Twin Cities PBS in your will is an easy way to make a generous gift to TPT.

In your will you have choices about how you name TPT as a beneficiary.

- You may wish to leave a fixed dollar amount to TPT. You will need to specify exactly how much you would like the station to receive.

- Another popular option is to give Twin Cities PBS a percentage of your estate. This makes good sense if you don’t have a clear idea of how much your estate will be worth at your death.

Tell Your Attorney

Below is suggested language that you might use in your will to designate Twin Cities PBS as a beneficiary.

I give devise to Twin Cities Public Television, Inc., a not-for-profit corporation of the State of Minnesota, ____percent of my estate (or the residue or the sum of $_____; or the properties, securities, etc. described herein) to be used for its unrestricted purposes, or for its endowment.

If You Already Have a Will

It is very easy to add a codicil to your will, which designates TPT as one of your beneficiaries.

Full Legal Name of TPT: Twin Cities Public Television, Inc.

Federal Tax I.D. Number: 41-0769851

Please let us know if you have included TPT in your plans.

DONOR ADVISED FUNDS

Through Donor-Advised Funds, you make irrevocable contributions to a fund you establish, often in your name or to honor a family member. The most typical charitable sponsors are community foundations and funds affiliated with financial service firms. You then claim a charitable deduction for income tax purposes and recommend that money be granted to TPT. These organizations work closely with us to fulfill your charitable goals. Please allow 2-3 months for your recommendation to be fulfilled by calendar year end.

FAMILY FOUNDATIONS

Another option to match your philanthropic intent with TPT’s public media mission is to make a grant from your family foundation. A private family foundation by law must distribute a minimum of 5% of its assets yearly to charity. TPT often benefits from family foundations who give grants for general operations or to fund a specific content area or program. TPT works closely with family members and/or foundation appointed administrators to jointly fulfill the mission of donors and TPT.

CHARITABLE GIFT ANNUITY

The Charitable Gift Annuity (CGA) is one of the oldest and most popular ways to support a favorite charity. It is simple to complete and provides income for you or another individual of your choice as well as tax benefits.

In exchange for your gift of cash or marketable securities, TPT agrees to pay you (and/or a loved one) an annual sum for the remainder of your life(lives). The amount of the annuity is based on the age of the income beneficiary(ies): the older you are, the higher the rate you will receive.

A CGA is a simple contract between a donor and a charity, such as Twin Cities PBS. The contract specifies the amount of income to be paid annually (the “annuity”) to the donor; the name of the individual (or individuals) who will receive the income; and the charitable purpose of the gift after the life of the income recipient(s).

CGAs can be established with a gift of $10,000 or more and qualify you for an immediate income tax deduction. And, a portion of the yearly income is tax-free. You may also receive favorable capital gains tax treatment when making gifts of appreciated property.

CHARITABLE REMAINDER ANNUITY TRUSTS

A Charitable Remainder Annuity Trust (Annuity Trust) is a gift plan defined by federal tax law that allows you to provide income to yourself or others while making a generous gift to Twin Cities PBS. The income may continue for the lifetimes of the beneficiaries you name, a fixed term of not more than 20 years, or a combination of the two.

CHARITABLE LEAD TRUSTS

A Non-Grantor Charitable Lead Annuity Trust (Lead Annuity Trust) is a gift plan defined by federal tax law that allows you to transfer assets to family members at reduced tax cost while making a generous gift to Twin Cities PBS.

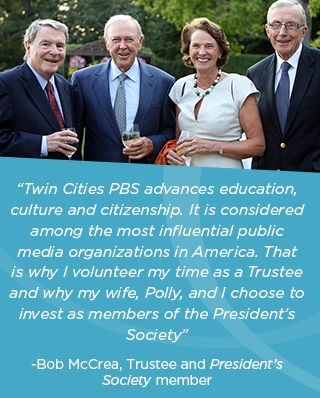

“Twin Cities PBS advances education, culture and citizenship and is considered among the most influential public media organizations in America.”

Bob and Polly McCrea, President’s Society members

“Twin Cities PBS advances education, culture and citizenship and is considered among the most influential public media organizations in America.”

Bob and Polly McCrea, President’s Society members

Visionary Society members help to secure TPT’s future, by including TPT in your will or estate plans.

Visionary Society contributors ensure that Twin Cities PBS (TPT) will be available for our children, our grandchildren and for generations to come.

Leaving a legacy can be as simple as amending your will or changing the beneficiary of your IRA or retirement plan and you can put TPT as a beneficiary on your life insurance policy. Your gift of any size, unless otherwise directed by you, will be designated for the station’s General Endowment Fund, where it will provide support for TPT in years to come.

Contact Cindy Hall-Duran, Sr. Manager of Gift Planning at 651-229-1276 or [email protected], or Bradley Reiners, JD, Planned and Major Gifts Officer at 651-229-1491 or [email protected] for more information. Please let us know if you have included TPT in your plans. Learn more about the Visionary Society here.

TAX STATUS AND IDENTIFICATION NUMBER

Full legal name of TPT: Twin Cities Public Television, Inc.

TPT Tax I.D. Number: 41-0769851

Twin Cities Public Television, Inc. is a 501(c)(3) tax-exempt organization under section 501(c)(3) of the Internal Revenue Code.

BENEFITS

Along with TPT member benefits like Passport, you will receive a number of additional opportunities afforded only to Visionary Society members including:

Along with TPT member benefits like Passport, you will receive a number of additional opportunities afforded only to Visionary Society members including:

- VIP studio tours.

- Screening events and exclusive gatherings with PBS luminaries such as Lidia Bastianich and Ken Burns.

- Exclusive invitations to Almanac Evenings, featuring a behind-the-scenes experience during the live broadcast of this award-winning public affairs series.

- Recognition on TPT’s donor listing.

|

HOW TO GIVE

|

There are a variety of ways to include TPT in your estate plans. Please consult your adviser for your best giving option(s). Below are a few recommendations for consideration.

BEQUESTS

Including Twin Cities PBS in your will is an easy way to make a generous gift to TPT. In your will you have choices about how you name TPT as a beneficiary. You may wish to leave a fixed dollar amount or you might want to give TPT a percentage of your estate in your will or trust.

Sample language for Wills & Trusts:

I give and devise to Twin Cities Public Television, Inc., a not-for-profit corporation of the State of Minnesota, _____ percent of my estate (or the residue or the sum of money $______; or the properties, securities, etc. described herein) to be used for its unrestricted purposes, or for its endowment.

CHARITABLE IRA’S AND OTHER RETIREMENT PLAN ASSETS

Gifts from a retirement account such as a IRA/Roth IRA or other qualified retirement plan assets, such as 401(k), 403 (b), or Keogh plan. To leave your retirement assets to TPT, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate TPT as beneficiary, we will benefit from the full value of your gift because your IRA assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

CHARITABLE GIFT ANNUITIES

A Charitable Gift Annuity (CGA) is a win-win giving option for many donors. It is a simple contract between you and TPT where, in exchange for your gift of cash or stock, TPT will pay you annual annuity for life. When payments end upon your death, any amount remaining in the contract is used to support TPT. Please contact us for more information and a personalized illustration.

MORE GIVING OPTIONS

CASH

STOCK

RETIREMENT PLAN ASSETS

IRA DISTRIBUTIONS

LIFE INSURANCE

BEQUESTS

DONOR ADVISED FUNDS

FAMILY FOUNDATIONS

CHARITABLE GIFT ANNUITY

CHARITABLE REMAINDER ANNUITY TRUSTS

CHARITABLE LEAD TRUSTS

CASH

A gift of cash is an easy way for you to make a gift to TPT. You can make an immediate impact on our mission and benefit from a charitable income tax deduction. Checks should be made out to Twin Cities PBS and mailed to:

Development Office

Twin Cities PBS

172 E. 4th Street

St. Paul, MN 55101

STOCK

Donating appreciated securities is a great way for you to make a gift to TPT. You can deduct the full present fair market value and you owe no tax on the appreciation in value. Stockbrokers require delivery instructions in writing. To make a stock gift to TPT, you will need to give the following information to your broker:

- Firm: UBS Financial Services Inc.

- Primary Contact: Michael Block, (612) 303-5842, [email protected]

- Twin Cities Public Television, Account number: 7A30673

- DTC number: 0221

Please also contact Abbey Sepich, Development Assistant, at (651) 229-1548 or [email protected] with your name, type of stock and the number of shares so we can provide documentation for your tax deduction.

RETIREMENT PLAN ASSETS

Donating part or all of your unused retirement assets such as a gift from your IRA (IRA charitable Rollover), 401(k), 403(b), pension or other tax-deferred plan is an excellent way to make a gift. Benefits of gifts of retirement assets:

- Avoid potential estate tax on retirement assets

- Your heirs would avoid income tax on any retirement assets funded on pre-tax basis

- Receive potential estate tax savings from an estate tax deduction

To leave your retirement assets to TPT, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate TPT as beneficiary, we will benefit from the full value of your gift because your IRA assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

IRA DISTRIBUTIONS

At age 70 ½, IRA owners are required by law to take mandatory minimum distributions. An increasingly popular way to make gifts tax-free, transfers to TPT must be made directly from the IRA or by writing a check from the IRA up to a $100,000 limit. Now that the IRA Charitable Rollover legislation is passed permanently, this enables donors to plan each year in advance.

LIFE INSURANCE

A gift of your life insurance is an excellent way to make a gift to TPT. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy. Contact your insurance provider, request a beneficiary designation form and include TPT as the beneficiary of your policy.

BEQUESTS

Including Twin Cities PBS in your will is an easy way to make a generous gift to TPT.

In your will you have choices about how you name TPT as a beneficiary.

- You may wish to leave a fixed dollar amount to TPT. You will need to specify exactly how much you would like the station to receive.

- Another popular option is to give Twin Cities PBS a percentage of your estate. This makes good sense if you don’t have a clear idea of how much your estate will be worth at your death.

Tell Your Attorney

Below is suggested language that you might use in your will to designate Twin Cities PBS as a beneficiary.

I give devise to Twin Cities Public Television, Inc., a not-for-profit corporation of the State of Minnesota, ____percent of my estate (or the residue or the sum of $_____; or the properties, securities, etc. described herein) to be used for its unrestricted purposes, or for its endowment.

If You Already Have a Will

It is very easy to add a codicil to your will, which designates TPT as one of your beneficiaries.

Full Legal Name of TPT: Twin Cities Public Television, Inc.

Federal Tax I.D. Number: 41-0769851

Please let us know if you have included TPT in your plans.

DONOR ADVISED FUNDS

Through Donor-Advised Funds, you make irrevocable contributions to a fund you establish, often in your name or to honor a family member. The most typical charitable sponsors are community foundations and funds affiliated with financial service firms. You then claim a charitable deduction for income tax purposes and recommend that money be granted to TPT. These organizations work closely with us to fulfill your charitable goals. Please allow 2-3 months for your recommendation to be fulfilled by calendar year end.

FAMILY FOUNDATIONS

Another option to match your philanthropic intent with TPT’s public media mission is to make a grant from your family foundation. A private family foundation by law must distribute a minimum of 5% of its assets yearly to charity. TPT often benefits from family foundations who give grants for general operations or to fund a specific content area or program. TPT works closely with family members and/or foundation appointed administrators to jointly fulfill the mission of donors and TPT.

CHARITABLE GIFT ANNUITY

The Charitable Gift Annuity (CGA) is one of the oldest and most popular ways to support a favorite charity. It is simple to complete and provides income for you or another individual of your choice as well as tax benefits.

In exchange for your gift of cash or marketable securities, TPT agrees to pay you (and/or a loved one) an annual sum for the remainder of your life(lives). The amount of the annuity is based on the age of the income beneficiary(ies): the older you are, the higher the rate you will receive.

A CGA is a simple contract between a donor and a charity, such as Twin Cities PBS. The contract specifies the amount of income to be paid annually (the “annuity”) to the donor; the name of the individual (or individuals) who will receive the income; and the charitable purpose of the gift after the life of the income recipient(s).

CGAs can be established with a gift of $10,000 or more and qualify you for an immediate income tax deduction. And, a portion of the yearly income is tax-free. You may also receive favorable capital gains tax treatment when making gifts of appreciated property.

CHARITABLE REMAINDER ANNUITY TRUSTS

A Charitable Remainder Annuity Trust (Annuity Trust) is a gift plan defined by federal tax law that allows you to provide income to yourself or others while making a generous gift to Twin Cities PBS. The income may continue for the lifetimes of the beneficiaries you name, a fixed term of not more than 20 years, or a combination of the two.

CHARITABLE LEAD TRUSTS

A Non-Grantor Charitable Lead Annuity Trust (Lead Annuity Trust) is a gift plan defined by federal tax law that allows you to transfer assets to family members at reduced tax cost while making a generous gift to Twin Cities PBS.

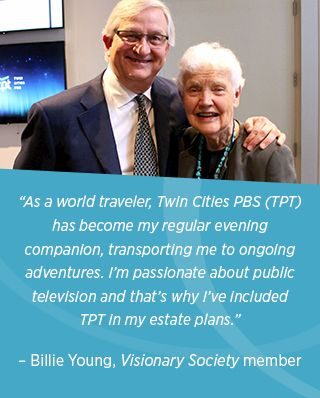

“We enjoy the consistent excellence in public media. Leaving a legacy through the Visionary Society is a way to support the common good.”

Miriam Simmons and James Schenz, Visionary Society members

“We enjoy the consistent excellence in public media. Leaving a legacy through the Visionary Society is a way to support the common good.”

Miriam Simmons and James Schenz, Visionary Society members

Cindy Hall-Durán | Sr. Manager of Gift Planning

651.229.1276 | [email protected]

Melinda B. Hoke | Vice President, Philanthropy

651.229.1240 | [email protected]

Mantha Petrovich | Associate Development Officer

651.229.1417 | [email protected]

Bradley Reiners, JD | Planned and Major Gifts Officer

651.229.1491 | [email protected]

Abigail Sepich | Development Assistant

651.229.1548 | [email protected]

Caitlin Zintl | Sr. Manager, Individual Giving & Development

651.229.1403 | [email protected]

© 2025 Twin Cities Public Television

test-08